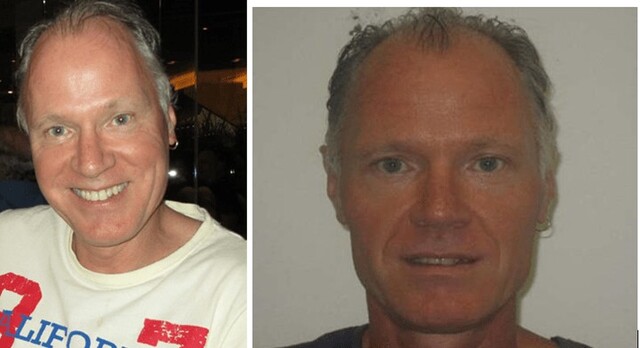

At 3.30pm on Friday 30 June Ronald Brown learnt the company building his dream house had suddenly collapsed.

Along with dozens of other anxious Bentley Homes customers, he started his weekend unsuccessfully trying to reach insurers and liquidators to determine the fate of the partially built homes.

“Everything we have is in that house, it just breaks your spirit,“ Mr Brown told AAP.

He and his wife have paid close to $300,000 for their home in Doreen in Melbourne’s north but are now unsure if they will be able to move in as planned in September.

The couple work five jobs between them and fear they will be unable to pay their rent and mortgage if there are any more delays.

“It’s not like we can just take on more work because we’re already at capacity,“ Mr Brown said.

“Our biggest concern at the moment is the financial stress and worry about how we’re going to continue paying for everything.“

Mr Brown believes their insurance policy should pay out about $80,000 but is yet to hear confirmation this will happen, describing this weekend as a waiting game.

AAP understands about 50 customers have been impacted by the liquidation.

On Friday, Timothy Holden of insolvency firm Crouch Amirbeaggi was appointed liquidator.

Mr Holden told AAP he was in the early stages of gathering information and would be in a position to report to creditors and homeowners early next week.

The building company cited economic pressures for its demise in an email to customers.

“Unfortunately, this leaves us in a position where we are unable to carry out any further works,“ Bentley Homes said in the email.

“Thank you for allowing us to be a part of your new home journey.“

Mr Brown visited his home under construction early on Saturday and contractors had already loaded materials onto trucks.

“I need to know the timeframes, I need to know options,“ Mr Brown said.

“If we know what they say then at least we can try to make a plan, go to the bank, talk to the bank, try to find a builder or someone that’ll be willing to complete it.“

A government spokesperson said liquidation was a trigger for domestic building insurance which all companies had to take out on behalf of customers by law.

“We understand the distress that customers will be feeling and urge them to follow the directions of their insurance policies,“ they said.